Federal Reserve keeps interest rates unchanged

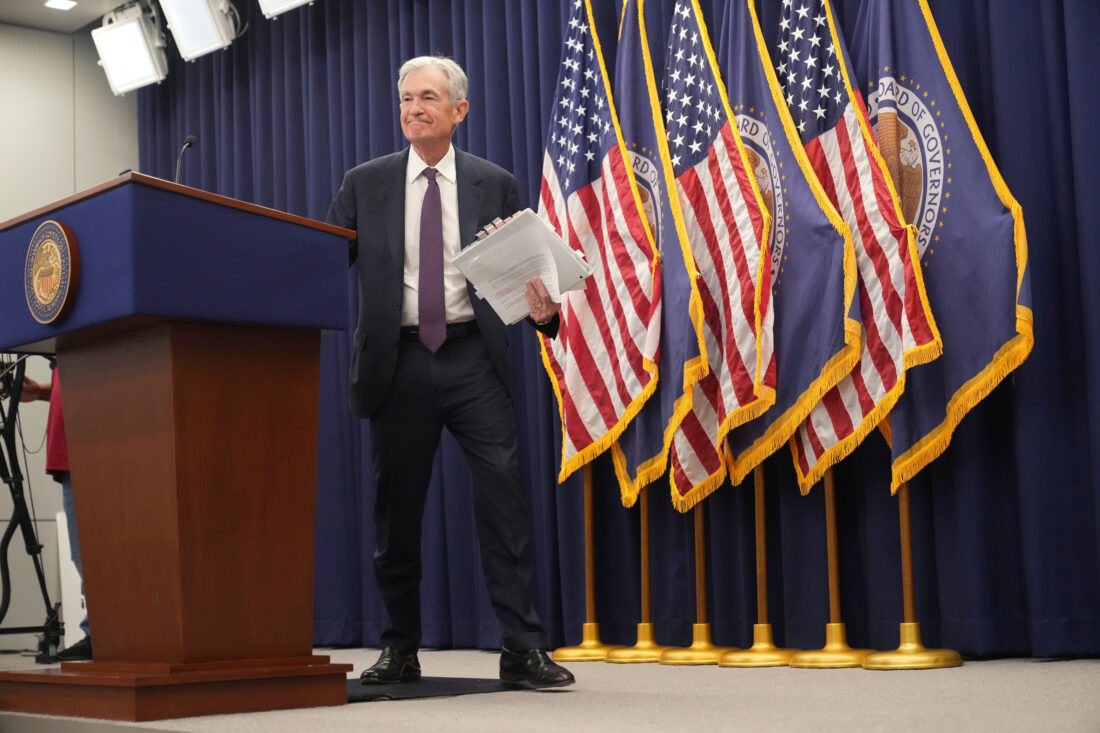

Federal Reserve Chair Jerome Powell leaves a news conference after a Federal Open Market Committee meeting, Wednesday, Jan. 28, 2026, at the Federal Reserve Board Building in Washington. (AP Photo/Jacquelyn Martin)

WASHINGTON — The Federal Reserve pushed the pause button on its interest rate cuts Wednesday, leaving its key rate unchanged at about 3.6% after lowering it three times last year.

Chair Jerome Powell said at a news conference after the central bank announced its decision that the economy’s outlook “has clearly improved since the last meeting” in December, a development that he noted should boost hiring over time. The Fed also said in a statement that there were signs the job market is stabilizing.

With the economy growing at a healthy pace and the unemployment rate appearing to level off, Fed officials likely see little reason to rush any further rate cuts. While most policymakers do expect to reduce borrowing costs further this year, many want to see evidence that stubbornly elevated inflation is moving closer to the central bank’s target of 2%. According to the Fed’s preferred measure, inflation was 2.8% in November, slightly higher than a year ago.

Michael Gapen, chief U.S. economist at Morgan Stanley, said that Powell kept the door open for further rate cuts this year, “when they get enough evidence inflation is decelerating.” Powell suggested in his remarks that the impact of tariffs, which have pushed up the cost of many goods such as furniture, appliances and toys, will peak in the middle of this year and inflation will fall after that.

In a sign of the unprecedented situation in which the Fed finds itself in Trump’s second term, Powell was asked to address a number of issues not directly tied to monetary policy but that could very well decide how the Fed implements its policy going forward.

Two officials dissented from Wednesday’s decision, with Governors Stephen Miran and Christopher Waller preferring another quarter-point reduction. President Donald Trump appointed Miran in September, and he had dissented at the three previous meetings in favor of a half-point cut. Waller is under consideration by the White House to replace Powell, whose term ends in May.

The Fed’s decision to stand pat will likely fuel further criticism from Trump, who has relentlessly assailed Powell for not sharply cutting short-term rates. A reduction in the Fed’s key rate tends to lower borrowing costs for things like mortgages, car loans, and business borrowing, though those rates are also influenced by market forces.